Mar 15, 2024 | ADVOCACY, PROBLEM GAMBLING, PROFESSIONALS

Wanted: community leaders interested in helping to educate and advocate for those in their community experiencing problem gambling.

MNAPG is in the process of organizing problem gambling awareness training sessions for community leaders to whom others turn for advice. The training is free and assists community leaders in helping others find the resources they need if they have a gambling problem.

The goal is to help those who need treatment get it as soon as possible. Research shows that it often takes seven to ten years before someone with a gambling problem seeks help. The earlier someone gets treatment, the lower the likelihood they will endure financial ruin, lose jobs and relationships, or experience a despair that ends in suicide.

In addition to helping people get help, community leaders are also in a position to reduce the stigma associated with gambling addiction. The goal of community leader training is to increase empathy and build knowledge about available resources rather than to provide professional treatment.

MNAPG will be offering the free, six-hour online training in partnership with Jody Bechtold from The Better Institute. Jody is a professional coach, gambling addiction expert, international speaker and trainer, and a Myers-Briggs Type Indicator ® certified facilitator.

Those taking the training will learn:

• Who is at risk for gambling disorder.

• The impacts on the family from gambling disorders.

• The often-overlapping occurrence of mental health problems, substance abuse and suicide.

• The need to understand finances in gambling disorders.

• Why it’s important to understand gambling-motivated crime.

• Choices for recovery and healing.

Following completion of the six-hour training, trainees will meet with MNAPG and other trainees for a two-hour in-person session to address questions or concerns. MNAPG’s goal is to build a network of trained leaders around the state to inform what additional resources and training may be needed to build greater awareness about gambling addiction.

Those interested in this training or desiring to learn more should contact Susan Sheridan Tucker. Remember, this training is offered at no cost.

Mar 15, 2024 | PROFESSIONALS

By the time a person suffering from a gambling addiction seeks professional help, they are often in dire straits. In addition to the emotional turmoil that causes some to feel suicidal and the path of destruction in personal relationships that often follows in their wake, there is also a very practical matter: most gambling addicts have spent their last penny.

While gambling counselors are equipped to help individuals manage their addiction, seek more healing ways and eventually start on the road to recovery, few have an in-depth knowledge of how the gambler can clean up from financial ruin. At best, counselors may have a few worksheets on basic budgeting that they can give to their clients, but they don’t have the range of tools that financial professionals can provide.

Recognizing that the lack of financial counseling represents a significant gap in treatment for many clients, MNAPG has dedicated resources for GamFin, an online financial education community for professionals in problem gambling, so that financial counselors can meet with individuals on an as-needed basis. The service is a boon to counselors — it represents an added and important service they can offer to their clients — and can provide an important anchor leg for those in recovery.

“When I heard that we could bring in a financial specialist to talk to our clients in a group session, I was thrilled,” says Amy Dady, a problem gambling counselor with Fairview Health Services. “It gives people a chance to ask about anything, such as budgeting, current financing, FICO scores, paying down debt, bankruptcy and future planning.”

Clients who want to ask specific questions can meet privately with the financial specialist — at no cost. “When clients know they can talk to the specialists for free, they open up and realize what an issue it is for them,” says Amy.

Access to financial counseling has received positive feedback. “I’m so delighted that my clients can go to them for counseling,” says Amy. “So much of the struggle and stress patients have is around the financial part. It’s great that we can provide these added benefits and that they don’t have to pay for them.”

“The dedication of these financial resources speaks to our larger effort to wanting to provide the best services to our stakeholders, in this case our counselors,” says Susan Sheridan Tucker, executive director of MNAPG. “Counselors lack financial training, but we feel it’s essential that gamblers have access to financial literacy services that can help them in their recovery. When counselors work in concert with the financial advisor, it’s a more comprehensive approach to a person’s overall recovery.”

Aug 14, 2023 | ABOUT MNAPG, PROBLEM GAMBLING, PROFESSIONALS, RECOVERY

The gambling landscape continues to shift with rapid expansion and responses to regulations that seem insufficient. Those working in prevention, treatment and research need to understand and be responsive to these changes.

The MNAPG conference will feature presenters from across the country and Canada sharing their perspectives as clinicians, financial advisors, people in recovery and researchers. It will be a great way to network with others committed to minimizing the harms caused by gambling disorder and to learn more about recent trends and new tools available for those who need help.

Who Should Attend?

The conference is appropriate for many people, including:

o Gambling, alcohol and drug addiction counselors and therapists

o Other health care and social service workers

o Law enforcement officers

o School and church leaders

o Lawyers and financial professionals

o People in recovery and their families

CEU credits are available from various Minnesota professional licensing boards.

Programs and Speakers

While conference details are still falling into place as of this writing, here are some of the programs and speakers that will be part of the conference:

o Resources and Tools for Financial Counseling in Gambling Disorder Treatment, presented by Cara Macksoud, CEO of Money Habitudes, and Alex De Marco, founder and CEO of MoneyStack, Inc. and GamFin.

o The All-In Podcast Comes to Minnesota!, presented by Brian Hatch, peer recovery specialist for Bettor Choice, and Jeff Wasserman, MPA, JD, ICGC-I, CPRS, judicial outreach and development director for the Delaware Council on Gambling Problems.

o Using Affordability Guidelines as a Tool for Player Protection Online in a North American Context, presented by Lia Nower, J.D., Ph.D., a distinguished professor and director of the Center for Gambling Studies at Rutgers University.

o Working with Clients and Gambling Harms: Why it Matters and How to Lower Resistance to Treatment, presented by Jay Robinson, JR Consulting, an internationally sought-after expert in the field of preventing and responding to gambling harms.

o The Public Health Impact of Sports Betting Expansion, presented by Dr. Timothy W. Fong, M.D., a Professor of Psychiatry at the Jane and Terry Semel Institute for Neuroscience and Human Behavior at UCLA.

What:

MNAPG annual conference

When:

Sept. 18

Where:

Hilton Minneapolis/Bloomington, 3900 American Blvd W., Bloomington, MN

Cost:

$30 (free to those in recovery)

Registration deadline: September 8

For More

Information:

mnapg.org/conference

Register and and learn more HERE.

Aug 10, 2022 | PROBLEM GAMBLING, PROFESSIONALS, RESOURCES

The gambling landscape continues to shift quickly, as new types of gambling and gaming activities proliferate. Those working in prevention, treatment and research need to understand and be responsive to these changes.

This year’s conference, which will be offered in person and online, will cover a variety of topics with two presentation tracks, one geared toward treatment professionals and another for a more general audience. The full conference will be recorded, so whether you join us in person or online, you won’t miss any of our content. CEUs will be offered.

Who Should Attend?

The conference is appropriate for many people, including:

- Gambling, alcohol and drug addiction counselors and therapists

- Other health care and social service workers

- Law enforcement officers

- School and church leaders

- Lawyers and financial professionals

- People in recovery and their families

- Policymakers

- Gaming operators and regulators

- Behavioral health researchers

- CEU credits are available from various professional boards.

Programs and Speakers

While conference details are still falling into place as of this writing, here are some of the programs and speakers that will be part of the conference:

- “Problem Gambling and Alexithymia: Implications for Interviewing, Screening, and Intervention,” presented by Jerrod Brown, Ph.D., Pathways of St. Paul.

- “Gambling Disorders in a New Era of Gambling,” presented by Jody Bechtold, LCSW, ICGC-II, BACC, CGT, CEO of The Better Institute.

- “How Can We Move Forward with Cultural Humility/DEI Absent a Strategic Plan? What’s Your Navigation System?” presented by Deborah Haskins, Ph.D., LCPC, board-approved supervisor, MAC, ICGC-II, CCGSO, BACC, CGT, President, Maryland Council on Problem Gambling.

- “Sports Betting Integrity and Today’s Student Athlete,” presented by Dan Trolaro, MS, Vice President of Prevention, Epic Risk Management.

- “Emergence of Problem Gambling from Childhood to Emerging Adulthood: A Systematic Review,” presented by Dr. Serena King, L.P., Professor and Chair, Psychology of Hamline University.

- What:

MNAPG annual conference

- When:

November 15

- Where:

Heritage Center of Brooklyn Center and virtually

- Cost:

Free

- Registration Deadline:

October 25 (for in person)

November 10 (for Zoom)

- For More Information: www.mnapg.org/conference

May 12, 2022 | PROFESSIONALS

Apr 29, 2022 | PROBLEM GAMBLING, PROFESSIONALS, RESEARCH

Read the original article on The BASIS here.

By Kira Landauer, MPH

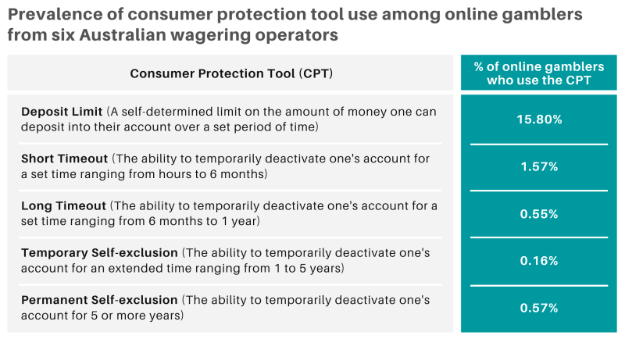

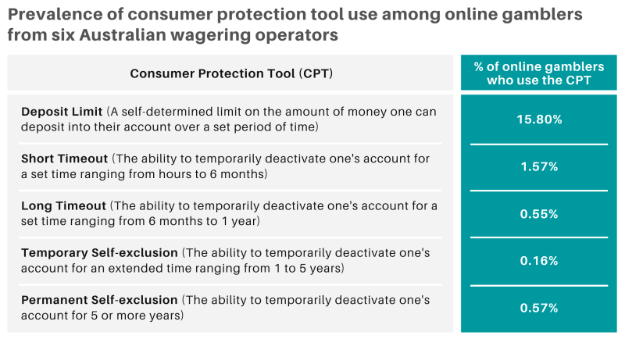

Many jurisdictions require online gambling operators to provide digital features that are intended to help players gamble more responsibly and minimize gambling-related harms. These consumer protection tools (CPTs) include setting limits on the amount of money one can deposit into their account (deposit limits), the ability to temporarily deactivate one’s account for a short period of time (timeouts), or the option to deactivate one’s account for a longer period of time (self-exclusion). But, do online gamblers actually use the CPTs available to them? This week, The WAGER reviews a study by Robert M. Heirene and colleagues that examined CPT use among customers of multiple online gambling operators in Australia in 2018 – 2019.

What were the research questions?

Which CPTs are used and how often are CPTs used by customers across six major Australian online gambling operators during a 12-month period? Does CPT use vary depending on customer demographics or wagering behavior?

What did the researchers do?

The researchers obtained de-identified account data for 39,853 customers across six online wagering operators in Australia. The records covered July 2018 to June 2019. All customers wagered at least once during this period. Customer data included demographics and (for the 12-month study period): the use of any CPTs (deposit limits, timeouts, and self-exclusion), transaction details (e.g., withdrawals and deposits), and all bets placed.

The researchers examined the overall prevalence of CPT use. They placed customers into quartiles based on their betting intensity (i.e., median number of bets per active betting day). CPT use was compared across customer betting intensity quartiles. The researchers also examined demographic characteristics and wagering behaviors among different groups of CPT users (non-uses, deposit limit setters, and timeout and/or self-exclusion users).

What did they find?

Only 16.8% of customers used at least one CPT during the 12-month study period. Deposit limits were the most frequently used CPT (15.8% of customers). Timeout and self-exclusion tools were used by less than 2% of customers (see Figure). CPT use increased linearly with gambling intensity. Rates of CPT use (timeouts and self-exclusion, in particular) were highest among customers who gambled more intensely. Customers most often used deposit limits first, or used deposit limits and a timeout in the same day. Many customers made changes to their deposit limits. Increasing the deposit limit (i.e., making it less restrictive) was the most frequent change. Customers who made the most changes to their deposit limits were more likely to increase or remove the limit.

Compared to non-CPT users and deposit limit setters, customers who used timeouts and/or self-exclusion were more likely to be younger, male, bet more times per active day, lost more money, deposited more money into their accounts, and had higher median stake amounts during the study period. Few differences were observed between the non-CPT users and the deposit limit setters.

Figure. The prevalence of use of different consumer protection tools among online gamblers from six Australian wagering operators (total n = 39,853).

Why do these findings matter?

Low rates of CPT usage might be attributed to a general lack of awareness that these tools exist. Further, customers may not be engaging with these tools due to the misperception that CPTs are intended for customers with gambling problems. Operators should do a better job of promoting these tools and communicating their relevance and benefits to all customers. Gambling operators might also consider using an “opt-out” strategy for certain CPTs, like deposit limits. In this case, customers would be provided an opportunity when signing up to either set a deposit limit or actively opt-out of doing so, which might increase the use of this CPT. Finally, this study found that limits are often increased or removed by customers at risk of experiencing gambling problems, at least according to their gambling intensity. Operators might consider imposing greater restrictions on the ability to increase or remove limits, and could consider implementing strategies to help customers set and stick to appropriate limits.

Every study has limitations. What are the limitations of this study?

This study used customer data from Australian gambling operators, where online gambling is restricted to sports and race wagering. Findings might not be generalizable to other jurisdictions that offer other forms of online gambling, such as online poker or casino games.

For more information:

Do you think you or someone you know has a gambling problem? Visit the National Council on Problem Gambling for screening tools and resources. For additional resources, including gambling and self-help tools, visit our Addiction Resources page.

— Kira Landauer, MPH

Page 2 of 8«12345...»Last »