Read the original article on The Basis website here.

By Kira Landauer, MPH

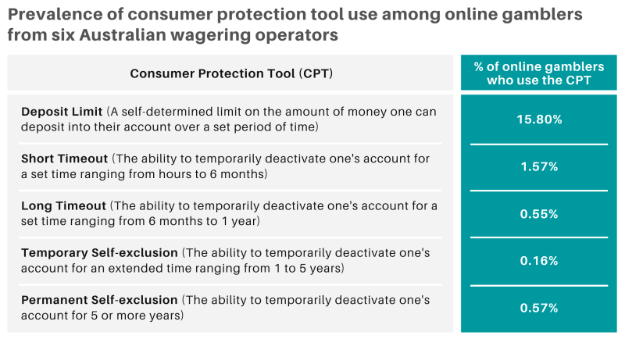

Many jurisdictions require online gambling operators to provide digital features that are intended to help players gamble more responsibly and minimize gambling-related harms. These consumer protection tools (CPTs) include setting limits on the amount of money one can deposit into their account (deposit limits), the ability to temporarily deactivate one’s account for a short period of time (timeouts), or the option to deactivate one’s account for a longer period of time (self-exclusion). But, do online gamblers actually use the CPTs available to them? This week, The WAGER reviews a study by Robert M. Heirene and colleagues that examined CPT use among customers of multiple online gambling operators in Australia in 2018 – 2019.

What were the research questions?

Which CPTs are used and how often are CPTs used by customers across six major Australian online gambling operators during a 12-month period? Does CPT use vary depending on customer demographics or wagering behavior?

What did the researchers do?

The researchers obtained de-identified account data for 39,853 customers across six online wagering operators in Australia. The records covered July 2018 to June 2019. All customers wagered at least once during this period. Customer data included demographics and (for the 12-month study period): the use of any CPTs (deposit limits, timeouts, and self-exclusion), transaction details (e.g., withdrawals and deposits), and all bets placed.

The researchers examined the overall prevalence of CPT use. They placed customers into quartiles based on their betting intensity (i.e., median number of bets per active betting day). CPT use was compared across customer betting intensity quartiles. The researchers also examined demographic characteristics and wagering behaviors among different groups of CPT users (non-uses, deposit limit setters, and timeout and/or self-exclusion users).

What did they find?

Only 16.8% of customers used at least one CPT during the 12-month study period. Deposit limits were the most frequently used CPT (15.8% of customers). Timeout and self-exclusion tools were used by less than 2% of customers (see Figure). CPT use increased linearly with gambling intensity. Rates of CPT use (timeouts and self-exclusion, in particular) were highest among customers who gambled more intensely. Customers most often used deposit limits first, or used deposit limits and a timeout in the same day. Many customers made changes to their deposit limits. Increasing the deposit limit (i.e., making it less restrictive) was the most frequent change. Customers who made the most changes to their deposit limits were more likely to increase or remove the limit.

Compared to non-CPT users and deposit limit setters, customers who used timeouts and/or self-exclusion were more likely to be younger, male, bet more times per active day, lost more money, deposited more money into their accounts, and had higher median stake amounts during the study period. Few differences were observed between the non-CPT users and the deposit limit setters.

Figure. The prevalence of use of different consumer protection tools among online gamblers from six Australian wagering operators (total n = 39,853). Click image to enlarge.

Why do these findings matter?

Low rates of CPT usage might be attributed to a general lack of awareness that these tools exist. Further, customers may not be engaging with these tools due to the misperception that CPTs are intended for customers with gambling problems. Operators should do a better job of promoting these tools and communicating their relevance and benefits to all customers. Gambling operators might also consider using an “opt-out” strategy for certain CPTs, like deposit limits. In this case, customers would be provided an opportunity when signing up to either set a deposit limit or actively opt-out of doing so, which might increase the use of this CPT. Finally, this study found that limits are often increased or removed by customers at risk of experiencing gambling problems, at least according to their gambling intensity. Operators might consider imposing greater restrictions on the ability to increase or remove limits, and could consider implementing strategies to help customers set and stick to appropriate limits.

Every study has limitations. What are the limitations of this study?

This study used customer data from Australian gambling operators, where online gambling is restricted to sports and race wagering. Findings might not be generalizable to other jurisdictions that offer other forms of online gambling, such as online poker or casino games.

For more information:

Do you think you or someone you know has a gambling problem? Visit the National Council on Problem Gambling for screening tools and resources. For additional resources, including gambling and self-help tools, visit our Addiction Resources page.

— Kira Landauer, MPH