Read the original article from The Wager Here.

Gambling can result in serious financial, emotional, social, and health problems for some people who gamble. Better understanding the extent and timing of the relationship between gambling and negative outcomes can help us improve interventions designed to reduce gambling-related harm. However, most past work is confined to self-report surveys and small-scale studies, which might have limitations due to inaccurate reporting or memory lapses. This week, the WAGER reviews a study by Naomi Muggleton and colleagues that was one of the first to examine gambling and gambling-related harms in a large sample using actual financial data measured across time.

What was the research question?

What is the association between gambling (as measured through gambling transactions) and financial, lifestyle/leisure, and health-related outcomes (as measured through financial transactions related to these domains)?

What did the researchers do?

The researchers used financial data from two samples of customers of a large UK bank: a random sample of 102,195 customers who were active (i.e., had active bank accounts) in 2018 (Sample 1); and all 6,515,557 customers who were active in 2013 (Sample 2). They measured how much of customers’ spending in a given month was spent on gambling transactions. Next, they created all of their outcome variables from information about customers’ transactions (e.g., whether they take a payday loan in a given month, or how much they spend on fitness-related activities and products). In Sample 1, they used regression models to look at the relationship between gambling spend in one month and measures of financial distress, financial planning/inclusion, lifestyle spending, health and well-being spending, and leisure and interests spending one month later during 2018. In Sample 2, they used logistic regression models and survival analysis to look at the relationship between spending on gambling in 2013 and measures of disability, unemployment, and mortality from 2014-2019.

What did they find?

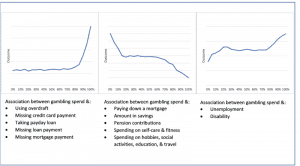

In Sample 1, people who spent a greater percent of their money on gambling transactions in one month were more likely to experience financial distress (e.g., using an overdraft, missing a credit card, loan, or mortgage payment), less likely to engage in financial planning and inclusion (e.g., holding a mortgage or having savings, paying down a mortgage or loan), less likely to spend on health or well-being (e.g., transactions related to fitness or self-care), and less likely to spend on other leisure and interests (e.g., transactions related to education or social activities) in the next month. These associations were non-linear; as the Figure shows, most relationships were much stronger at high levels of gambling. Gambling spend did not demonstrate a consistent relationship with lifestyle spending (e.g., spending on gaming or tobacco).

In Sample 2, people who spent a greater percent of their money on gambling transactions in 2013 were more likely to experience unemployment or disability (as measured by unemployment and disability

payments) in 2014-2019, and had higher mortality (as measured by a flag placed on a customer’s account following that customer’s death) in those same years.

Figure. Common associations between spending on gambling transactions and financial, health, and leisure & interests. In these graphs, the x-axis shows percentile of gambling spend (e.g., 1% includes individuals in the sample who were in the lowest 1% in terms of how much of their spending was on gambling; 99% includes individuals in the sample who were in the 99th percentile in terms of how much of their spending was on gambling). The y-axis measures either the level of the outcome (e.g., how many pounds [£] an individual has in savings), or the percent of customers who had that outcome (e.g., the percent who missed a mortgage payment). The charts do not depict actual data from the study, but representative curves for each set of outcomes. Adapted from Muggleton et al. (2021). Click image to enlarge.

Why do these findings matter?

This study confirmed that gambling is associated with a wide range of negative outcomes, using objective, representative data based on millions of banking records. It is one of the largest studies ever conducted on gambling transactions and how they relate to other financial transactions. However, the study also showed that in most cases, these relationships are much stronger at higher levels of gambling. The results of these studies can be used to guide interventions and prevention efforts. For example, banks could develop messaging to send to customers whose spend on gambling in relation to the rest of their spending exceeded a certain level providing information about gambling and its risks or helpful tools and resources. This would be similar to current efforts to determine lower-risk thresholds for gambling and raise awareness of those thresholds among gamblers. All messaging efforts should be tested to ensure they have the intended effects.

Every study has limitations. What are the limitations of this study?

This study staggered measurements of gambling spend and outcomes in time, but this approach does not definitively establish causality. It is possible that both high levels of gambling and high levels of these negative outcomes reflect other underlying factors that drive both the gambling behavior and other behaviors.

For more information:

Do you think you or someone you know has a gambling problem? Visit the National Council on Problem Gambling for screening tools and resources. For additional resources, including gambling and self-help tools, please visit The BASIS Addiction Resources page.

What do you think? Please use the comment link below to provide feedback on this article.

— Sarah Nelson, Ph.D.