Read the original article on The Basis HERE.

By Kira Landauer, MPH

Harms associated with gambling can have significant consequences for the gambler and their loved ones. Financial consequences are common, but little is known about the lived experience of financial harm from gambling. This week, The WAGER reviews a study by Sarah Marko and colleagues that explored how people who have been negatively impacted by their own or someone else’s gambling view and manage the financial risks and harms associated with gambling.

What were the research questions?

(1) How do people who have been negatively impacted by gambling perceive their risk of experiencing gambling-related financial harms?, and (2) How do they manage these financial harms?

What did the researchers do?

The researchers conducted semi-structured interviews with 21 Australian adults (11 men and 10 women) who had been negatively financially impacted by their own gambling (gamblers) or someone else’s gambling (affected others). All participants had experienced housing-related financial problems associated with gambling. They were interviewed about their experiences. The researchers analyzed the interviews for common themes pertaining to financial risks and harms associated with gambling.

What did they find?

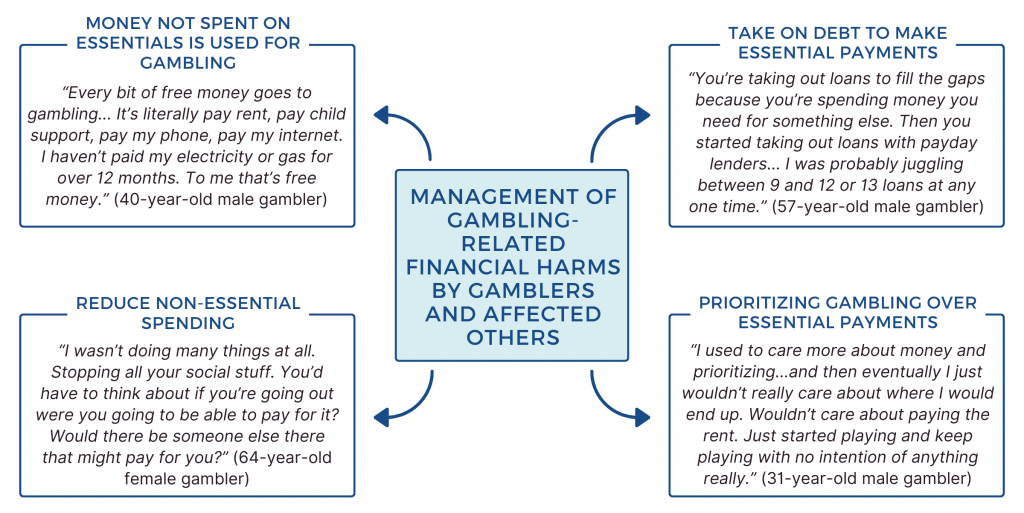

Most gamblers and affected others didn’t consider the potential risks of gambling until the monetary losses began impacting their lives, such as their ability to make essential payments like bills or rent. Early experiences of harm were not recognized because gambling was viewed as entertainment and as a social activity. Gamblers and affected others changed their money management behaviors to manage these impacts, including: (1) adjusting financial priorities and spending habits, (2) reducing spending in non-essential areas (e.g., house maintenance, social events), and (3) taking on debt to cover expenses. Some gamblers reached a point where the financial impacts became too unmanageable, and they redirected most of their money to gambling. Financial harms had long-lasting effects, including loss of housing due to eviction or foreclosure and trouble finding stable long-term housing due to factors like poor rental history or bad credit. Many gamblers and affected others tried to maintain an outward appearance of financial stability to conceal the extent of the negative impacts of gambling due to the stigma surrounding gambling problems and debt.

Figure. Quotations about the management of gambling-related financial harms among n =21 gamblers and affected others. Click image to enlarge.

Why do these findings matter?

These findings demonstrate the complexity of gambling-related financial harms experienced by gamblers and affected others. Current messaging around the use of safer gambling strategies might contribute to the notion that gambling harm is something that can be managed by gambling ‘correctly’. It might also reinforce the stigma associated with gambling problems and debt. Public messaging about minimizing financial gambling harms should draw from lived experience and not focus solely on personal responsibility. For example, messaging could depict actual experiences of harm in people’s lives — a strategy used in other areas like tobacco control.

Every study has limitations. What are the limitations of this study?

Most participants were over the age of 40, so these findings might not be generalizable to other age groups. The study only included a small number of affected others, all of whom were women. Their experiences might vary depending on their relationship to the gambler; additional research is needed with a larger and more diverse sample of affected others.